Posted: January 2026

Prepared by ReLISTO

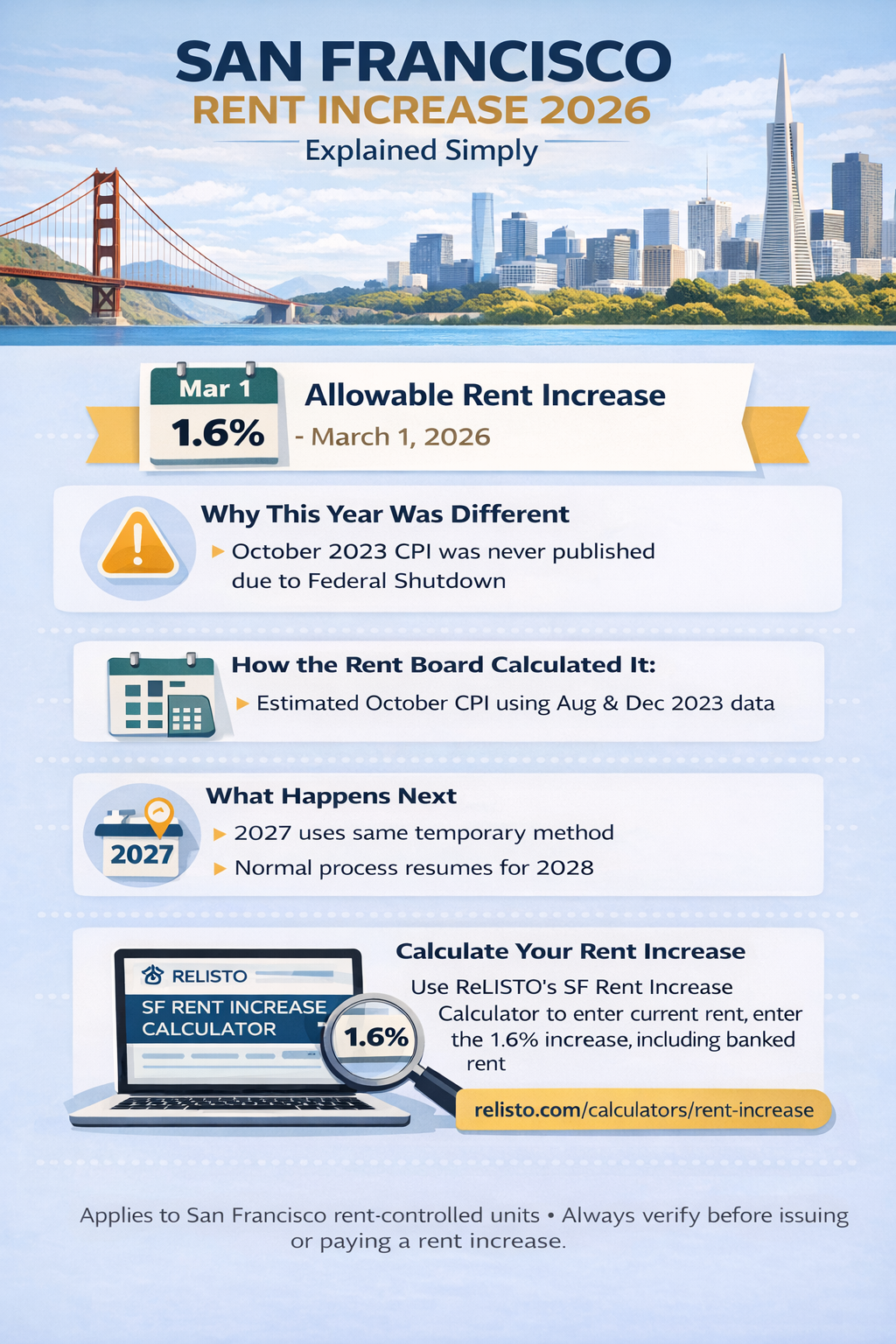

Each year, San Francisco sets a citywide limit on how much rent can be increased for rent-controlled apartments. For rent increases effective March 1, 2026 through February 28, 2027, the San Francisco allowable rent increase is 1.6%.

This percentage applies to San Francisco rent control units and is published annually by the San Francisco Rent Board. While the percentage itself is straightforward, how it was calculated this year — and how it should be applied — is not.

Behind the 1.6% figure is an unusual situation involving missing federal inflation data, a temporary adjustment by the Rent Board, and a calculation process that many landlords and tenants are understandably confused about. Below is a clear explanation of what happened, what the current rent increase rules are, and how to calculate a lawful rent increase correctly.

How San Francisco Rent Increases Are Normally Calculated

Under the San Francisco Rent Stabilization Ordinance, annual rent increases are tied to inflation using the Consumer Price Index (CPI) for the San Francisco region.

Normally:

– The Rent Board compares October-to-October CPI data

– The allowable rent increase equals 60% of inflation

– The result is rounded to the nearest tenth

– The increase is capped at 7%

– The increase becomes effective March 1 each year

Normally:

– The Rent Board compares October-to-October CPI data

– The allowable rent increase equals 60% of inflation

– The result is rounded to the nearest tenth

– The increase is capped at 7%

– The increase becomes effective March 1 each year

This methodology has been used consistently for decades and applies to most rent-controlled apartments in San Francisco.

Why the 2026 San Francisco Rent Increase Was Different

In 2025, a federal government shutdown prevented the U.S. Bureau of Labor Statistics from publishing the October 2025 CPI. The BLS later confirmed that this data will never be published retroactively.

Because San Francisco law specifically requires an October-to-October comparison, the Rent Board could not calculate the annual allowable rent increase using its normal method — not just for 2026, but for two consecutive years. This created a technical problem, not a policy change.

How the San Francisco Rent Board Calculated the 1.6% Increase

To address the missing CPI data, the Rent Board considered two approaches. The method ultimately used was to estimate the missing October 2025 CPI using a recognized statistical technique called a geometric mean.

In simple terms:

– The Rent Board used published CPI data from August 2025 and December 2025

– It calculated the midpoint between those two figures

– That estimate was used in place of the missing October data

– That estimate was used in place of the missing October data

This approach allowed the Rent Board to:

– Rely only on published federal CPI data

– Preserve the long-standing October-to-October framework

– Avoid skipping or double-counting inflation

– Preserve the long-standing October-to-October framework

– Avoid skipping or double-counting inflation

Using this method, the San Francisco allowable rent increase for 2026 was set at 1.6%.

What Happens in 2027 (and Beyond)

Because the October 2025 CPI was never published, a similar temporary methodology will be required again for the 2027 allowable rent increase.

Once the CPI timeline fully moves past the missing data, the Rent Board can return to its standard calculation method. In other words:

– 2026 and 2027 are transition years

– Future years will return to the normal process

– Future years will return to the normal process

What the 1.6% Rent Increase Means for Landlords and Tenants

Here’s what matters in practice:

– 1.6% is the maximum allowable rent increase for covered units

– The increase applies to rent increases effective on or after March 1, 2026

– Banked rent increases may still be applied where allowed

– Rent control coverage and tenant protections have not changed

– Improperly calculated increases may be partially or fully unlawful

– 1.6% is the maximum allowable rent increase for covered units

– The increase applies to rent increases effective on or after March 1, 2026

– Banked rent increases may still be applied where allowed

– Rent control coverage and tenant protections have not changed

– Improperly calculated increases may be partially or fully unlawful

Because banked rent and rounding rules apply, two landlords using the same percentage may still end up with different lawful rents.

Calculate Your San Francisco Rent Increase

San Francisco publishes the annual allowable rent increase percentage, but it does not provide a calculator that applies the increase to a specific unit or accounts for banked rent. That calculation is left to landlords and tenants to perform correctly.

ReLISTO’s San Francisco Rent Increase Calculator fills that gap. It allows landlords and tenants to calculate rent increases down to the penny, including the correct application of banked rent under San Francisco rent control.

Use the calculator here:

https://www.relisto.com/calculators/calculator/rent-increase

The tool is designed to eliminate guesswork, reduce disputes, and help both parties clearly understand what is — and is not — allowed per City guidelines. Best of all its free and you don’t need to enter any personal data!

If you’re planning a rent increase or reviewing one you’ve received, using a precise, rules-based calculator is one of the easiest ways to stay compliant and informed.