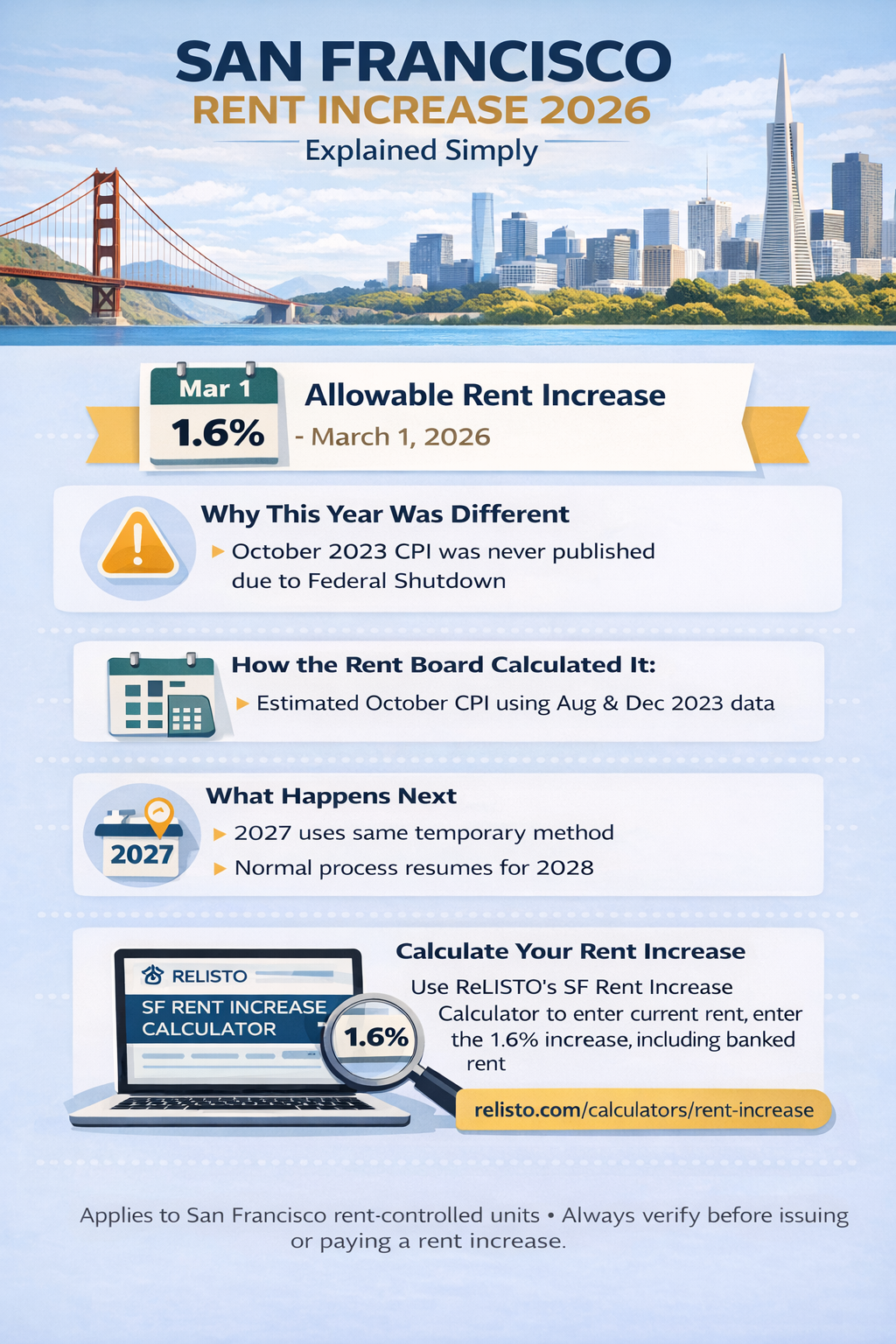

Posted: January 2026

Prepared by ReLISTO

This percentage applies to San Francisco rent control units and is published annually by the San Francisco Rent Board. While the percentage itself is straightforward, how it was calculated this year — and how it should be applied — is not.

Behind the 1.6% figure is an unusual situation involving missing federal inflation data, a temporary adjustment by the Rent Board, and a calculation process that many landlords and tenants are understandably confused about. Below is a clear explanation of what happened, what the current rent increase rules are, and how to calculate a lawful rent increase correctly.

How San Francisco Rent Increases Are Normally Calculated

Normally:

– The Rent Board compares October-to-October CPI data

– The allowable rent increase equals 60% of inflation

– The result is rounded to the nearest tenth

– The increase is capped at 7%

– The increase becomes effective March 1 each year

This methodology has been used consistently for decades and applies to most rent-controlled apartments in San Francisco.

Why the 2026 San Francisco Rent Increase Was Different

Because San Francisco law specifically requires an October-to-October comparison, the Rent Board could not calculate the annual allowable rent increase using its normal method — not just for 2026, but for two consecutive years. This created a technical problem, not a policy change.

How the San Francisco Rent Board Calculated the 1.6% Increase

In simple terms:

– That estimate was used in place of the missing October data

This approach allowed the Rent Board to:

– Preserve the long-standing October-to-October framework

– Avoid skipping or double-counting inflation

Using this method, the San Francisco allowable rent increase for 2026 was set at 1.6%.

What Happens in 2027 (and Beyond)

Once the CPI timeline fully moves past the missing data, the Rent Board can return to its standard calculation method. In other words:

– Future years will return to the normal process

What the 1.6% Rent Increase Means for Landlords and Tenants

– 1.6% is the maximum allowable rent increase for covered units

– The increase applies to rent increases effective on or after March 1, 2026

– Banked rent increases may still be applied where allowed

– Rent control coverage and tenant protections have not changed

– Improperly calculated increases may be partially or fully unlawful

Because banked rent and rounding rules apply, two landlords using the same percentage may still end up with different lawful rents.

Calculate Your San Francisco Rent Increase

ReLISTO’s San Francisco Rent Increase Calculator fills that gap. It allows landlords and tenants to calculate rent increases down to the penny, including the correct application of banked rent under San Francisco rent control.